Poor & middle class (response)

Note: I live in the UK, so a lot of prices are going to be in pounds sterling (£). A few things may vary (houses might be cheaper in the US, but you’ve got property tax, whereas we don’t; on the other hand, student loans are completely fucked up there and healthcare is not universally accessible).

So let’s get on with it.

The poor is not getting poorer. …evidence to the contrary?

There’s a billion fewer people in extreme poverty every decade, the middle class is exploding worldwide, 90% of the world has a smartphone

Absolute/extreme poverty is currently (2022) defined as living on less than $1.90/day (source)

The amount was $1.00/day in 1996.

Looking at these amounts, it’s easy to understand why the number of people in “extreme poverty” is supposedly dwindling. By that measure, there are no Americans/Europeans in extreme poverty.

The trick here is to understand that the definitions are tainted and bogged down in a web of lies. Although I’ll try to explain it to the best of my ability (note that English is my fourth language and as such…I may not be up to the task), it’s NOT going to be easy to understand.

In order to understand this, you first need to look at what “middle class” used to mean say…50-60 years ago and at what it means today.

In the 60s/70s, a 25 y/o middle-class man would normally own a (fairly large by today’s standards) home. He’d own a car. He’d most likely be married and he’d have a few children. His wife might be a “homemaker” (not employed, in other words). That person would not typically have to worry about money. There would be things he couldn’t (easily) afford, but those would be due to technological limitations (no, of course he wouldn’t have owned a smartphone or a flat-screen TV; they didn’t exist). Having a random blue-collar job (which required basically no formal qualifications) would make you “middle-class”.

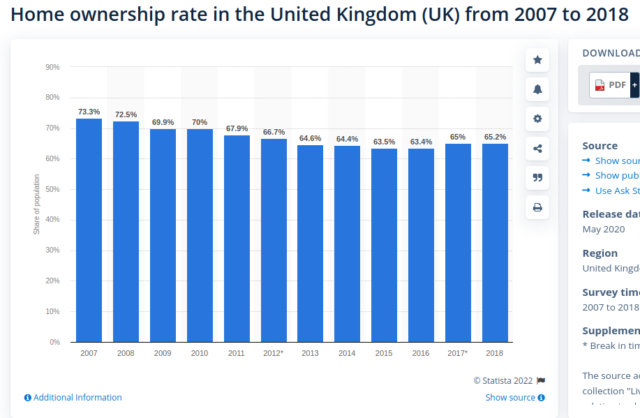

Fast-forward to 2022, the average age of the first-time buyer in the UK is 33-35 (source). Note that a lot of these are only possible because parents are happy to contribute to the deposit – a situation generally described as BOMAD (Bank of Mum and Dad).

A poor person in the 60s/70s COULD own a small flat in the part of town you’d generally avoid driving through. In extreme cases, that would be more of a shack.

A poor person in 2022 can’t afford to buy a garage to live in.

So let’s take a look at what happened using two houses which have been sold several times – with the first recorded sale in 1995 (that’s not to say they were new in 1995; it’s just that nobody bothered to record these sales for a long time)

The first house was sold on the 13th of December 1995 for £70,000. It was sold again on the 1st of October 2021 for £498,000 – the price was just over 7.11 times higher compared to 1995.

The second house was sold on the 26th of January 1995 for £117,500. It was sold again on the 30th of September 2021 for £675,000 – the price was just 5.74 times higher compared to 1995.

Note that the original price showed there is from 1995. Prices were significantly different in the 60s or 70s (as in, houses were significantly cheaper). It’s difficult to find “real data” from “back then”, since computers and databases weren’t really “a thing” – most archives would still be hefty dossiers stashed in a basement, somewhere. Occasionally, however, you can find a few articles on the topic, although they may not go back all the way to the 60s.

Such an example is here.

To quote from it:

My sister and her partner, both working for Hackney council in the housing department and press office, had bought a four-bedroom house in Lower Clapton for £42,000 in 1984

These were not well-paid jobs. The author explains that further down the line.

Personally, I never liked Hackney. I thought it would always be a doomed poor relation of Islington and the transport links were appalling. (Today, similar sized properties on the road my sister lived are worth around £850,000; entry level council salaries are around £18,000).

Note that the 18k salary she’s referring to is from 2015, so you can only imagine what they were getting paid in 1984.

Within a few months I had bought my first flat. It was on Dulwich Road between Brixton and Herne Hill, with a shared garden leading down to Brockwell Park. I paid £32,750 for it, which was three times my salary as a communications officer for Age Concern Lambeth, minus £250. A mortgage broker arranged it for me. No one even mentioned a deposit.

You are talking about a PR job here. One could infer that the lady was on ~11k/year.

Data from that period is difficult to find. It’s not impossible, but it’s definitely not easy to find it.

So let’s take a look at the figures from that time.

This is the average disposable income per household per year in the UK, as shown on statista (feel free to look it up there, but the site is full of paywalls and whatnot).

As you can see, the median is at 15447/year – in other words, 47% of what the lady paid for her flat in London in 1984.

She sold the flat in 1994 for £57,000. The average disposable income per household per year was at £19699 in 1994 (again, we’re looking at the median). 10 years later, the average disposable income no longer paid for 47% of that flat (now older and possibly less shiny given the passage of time). It “now” bought 34%

She bought the next place in 1994, once she sold the older flat – that was £92,000.

She then sold that second flat in 2014 for £660,000.

So let’s measure that again:

– In 1994, when she bought the second flat, the disposable household income per year was at £19699. She paid £92000 for the flat. That means that the disposable household income could buy 21% of that flat in 1994.

– In 2014, when she sold the flat she had bought for £92,000, the disposable household income per year was £28074, but the flat sold for £660,000. That means that the disposable household income could buy 4% of that flat (figures below)

The trend continued well into 2020, 2021 and finally 2022.

(it’s worth noting that “disposable” by their definition doesn’t really mean “disposable”, as in “what you’re left with after bills, rent, food etc)

What we’re seeing here is something anyone could tell you – the regular person can’t do that anymore, not on their own. While London figures do not reflect the situation in the entire country, things aren’t too different in other places (prices do vary, but so do wages)

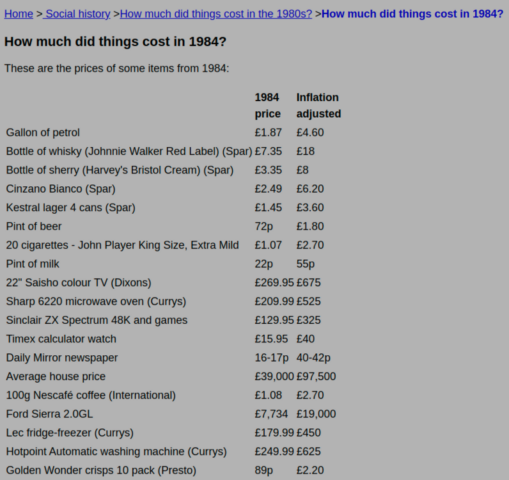

Now let’s take a look at prices in 1984.

It’s difficult to pick items from that list to check now, simply because a lot of them don’t really matter anymore (nobody’s going to buy a 22″ color TV or a Sharp 6220 microwave or a pocket calculator), but there are a few items that are still being sold, such as milk, cigarettes, whisky, petrol.

We can see that a pint of milk used to cost 22p. It’s now 60p at Tesco.

We can see that you had to pay £1.07 for a pack of cigarettes (JPS). This is £10.80 nowadays at Sainsbury’s

Whisky (JW Red Label) was £7.35. It’s now £22 at Tesco.

A gallon of petrol was £1.87. A gallon equals 4.54609 litres in the UK, meaning that the price was 41p/litre. It’s currently at least 146p – 3.5 times more expensive.

It’s not difficult to see that the price of milk went up ~3 times, the price of cigarettes went up ~10 times and the price of whisky went up ~3 times. An argument could be made that cigarettes are now “taxed” differently and that alcohol is bad for you and whatever. Fine, but milk isn’t and that still went up 3 times. Again, the average disposable household income was 15447/year in 1984; the average disposable household income in 2021 was 29897/year. In other words, prices went up 3-25 times (3 times for some groceries, 25 times for houses) for various things, while the disposable household income didn’t even double.

There’s another thing you need to understand here: the lies behind those two words: “average” and “disposable”.

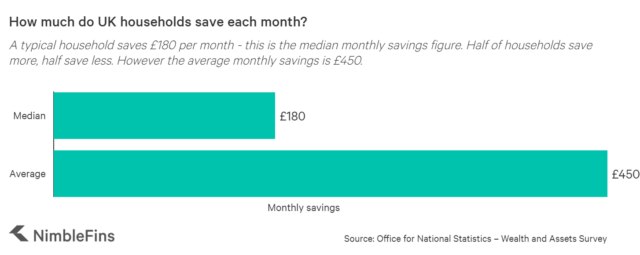

In order to understand this, let’s take a look at the highlighted text here:

(source; note that they use ONS figures – that is, official ones)

1. Note the difference between the average (£76,301) and the median (£12,500). This should tell you all you need to know about “average”. The average is a lie, simply because you’re looking at 10,000 people and 1 billionaire and suddenly everyone’s well-off, if not rich. It’s completely pointless to try to measure anything by it. Yes, Jeff Bezos and Elon Musk may have made billions or trillions or whatever during the pandemic. Good for them, but that doesn’t change anything for the regular person.

2. Also note that those “gross” figures do not take into account debt. That means that someone is counted as “having saved £12,500” when they’ve got £12,500 in their bank accounts, even though that same person might owe £50,000, which wouldn’t be a lot because the average student graduates with £45,000 in debt:

The average debt among the cohort of borrowers who finished their courses in 2020 was £45,000.

Source? The fucking Parliament

It wouldn’t be unreasonable to expect that average student to also owe £5000 more (credit card or whatever), would it? The figure might be even higher in the US.

It’s also worth noting that the equity you own once you get a mortgage (even though it’s just 10% of the house, for example) is counted as an asset, while the rest of it (the 90% + interest you owe) is ignored. As such, someone who managed to pay off 20% of their mortgage could be counted as having 50k in savings, even though they don’t actually have jack shit in their bank accounts and they’re actually living paycheck to paycheck.

25% of households have less than £2,100 saved. Note that £1 is also less than £2,100.

However, even though 25% of households are basically one paycheck away from becoming homeless, they’re not considered extremely poor. That’s because they’re all making over $1.90/day. It’s basically impossible to consider anyone in the UK “extremely poor”, simply because you get more than $1.90 even if you’re on benefits (social security or whatever that might be called in the US). Of course, that doesn’t mean anything, really, when the average rent looks like this:

It may be worth taking a look at this:

The median household saves £180/month. Note that this means that half of them manage to save less, possibly nothing – and remember to look at the average rent in various areas (the graph is available in this post) to get an idea of what that’s worth.

So, in reality, although the “average” “disposable” household income is higher now than it was in the 60s-70s-80s, it buys LESS in terms of items you ACTUALLY NEED. To clarify that, let’s take a look at Maslow’s pyramid.

What do we have at the base of the pyramid? Physiological needs. These include air, water, food, shelter, sleep, clothing, reproduction.

If you were wondering why I spent so much time on housing this should make it clear. Safe & stable housing is directly linked to some of those. Very few people nowadays own land (not houses; land); as such, they wouldn’t have their own “well”; they’d drink tap-water (at least in Europe), which implies having a place to live; food is also tied to that, as the cheapest food you can get is the food you cook yourself, but in order to cook it, you’ll need a home. It’s not like you can walk outside and fire up a grill in the middle of the street, unless you’re looking to get arrested. Shelter and sleep are also tied to housing.

I would go as far as arguing that it’s also tied to reproduction, from a certain point of view. It’s not that you can’t have children if you don’t own a house. It’s that if you want to have children with the woman of your choosing, you’ll need to be SOMEWHAT successful (the definition for that has also changed, it no longer matters who the best bowman/swordsman is). Unless you happen to be REALLY good-looking AND lucky (not every good-looking man ends up being a successful actor/model/whatever), you are going to have to be somewhat successful. Faced with choosing between having children with guy #1 who still lives with his parents and who can’t afford a taxi and having children with guy #2 who has his own place and owns a car, most adult females are going to choose guy #2, assuming no other major differences exist between them. That’s not to say that women are materialistic; I simply mean that any woman who isn’t brain-damaged or high on a regular basis is going to wonder “well, where are we going to raise a child? who’s going to support me while I’m unable to work before and just after childbirth?”. These are perfectly valid questions.

Just in case you doubt that, let me point you to this article in the Washington Post: the share of Americans not having sex has reached a record high

This brings us to your flawed argument:

90% of the world has a smartphone (and are about to get satellite internet/unprecedented access to education),

That may be true, but there’s a problem with that. You no longer get a smartphone for … “social status”. That may have been true in the 90s at some point, but it’s no longer the case. Having a smartphone/laptop and internet access wouldn’t lift someone out of poverty. In fact, those are requirements if you’re poor. To clarify that, you need one…device and internet access even just to apply for benefits / universal credit; in order to keep receiving benefits, you have to prove that you’re actively looking for a job; how are you going to do that in 2022 without internet access, without a smartphone? You don’t just buy a newspaper and start looking at “classifieds” anymore, do you? As such, having a smartphone doesn’t do anything to change your social status, it’s merely another thing you NEED just to be poor instead of completely destitute. Besides, you can buy a smartphone for $50 nowadays, it’s not exactly THE problem.

To underline this, I’ll quote Adam Smith – his definition of poverty, to be precise:

poverty is the inability to afford “not only the commodities which are indispensably necessary for the support of life, but whatever the custom of the country renders it indecent for creditable people, even of the lowest order, to be without

In a “digital society” where you basically need internet access for anything relevant, you can’t really bring up smartphones as proof that fewer people are poor.

The issue with your argument (widely used by a certain segment of the media) is that it’s a half-truth, which is the best type of lie. Yes, more people have access to various tools they need just to get by – like smartphones. No, that doesn’t lift them out of poverty. It can’t. Yes, you’re renting a place with 2 strangers because you can’t afford to rent by yourself, but your landlord left a flat screen TV in there; well, of course he did, it’s not like he could’ve left a CRT, they’re not made anymore! Yes, you do have access to some things that may fall under “Aesthetic needs” or perhaps “Esteem needs”, but you don’t have the things you need for the base of the pyramid. As such, everything above that first level is rendered meaningless.

So what do we need to look at? Well, we need to understand that poverty is relative.

Someone living on $300/month in the US is as poor as someone living on $15/month in Bangladesh, possibly poorer. But the figures you’re normally shown claim that there are fewer people in absolutely poverty. That’s true, because the definition is a joke. $1.90/day? That means that there are no people in absolute poverty anywhere in the US or in Europe. Even the poorest American is probably able to get more than that in food stamps. The poorest Brit can get more than that in Universal Credit. But how does that help when that’s not enough to rent a place, no matter how pathetic that place might be? Never mind heating or food.

It’s enough to take a walk in Paris, in San Francisco, in London. You’ll find people in rags sleeping on the street in the cold, waiting to die. You’ll find people in the US who can’t afford insulin (and die) and you’ll find people in the UK who can’t afford to eat. Yet none of these people are considered in “extreme poverty”. Freezing and dying out there, in the street, does not count as being extremely poor. Nope, your frozen corpse is too rich for that, chances are you had $2 in your pocket.

Nobody ever spoke of “Generation Rent” in the 60s, 70s, 80s. Nobody heard of “the precariat” back then – and it wasn’t because the term hadn’t been coined. It was because there was no such thing. Worst case scenario, you could go and get a “lower class” job – I don’t know, fill gas tanks, work in a restaurant, whatever.

Speaking of jobs, I mentioned student loans and you mentioned education, but let’s take a long, hard look at the elephant in the room: “inflation” – not money-wise, but “education-wise”, if that makes sense. The same job you could get as soon as you left high-school (possibly before) may now require a bachelor’s degree – in some cases, a master’s degree. A lot of students may have chosen to “skip” college and join the workforce directly, but that’s not really an option anymore. That bachelor’s degree will BARELY afford you to SURVIVE in most cases (as described above – shared accommodation etc; there are exceptions, of course, not many MIT graduates are going to struggle, I imagine). It’s worth noting that I’ve seen cashier jobs that require a college degree in my home country. You have to be able to add, subtract, multiply (not really, the machine will do it for you, you usually just have to “scan” products), but you need a college degree for it. There’s something to be said about why and how this happened, but that would probably double the length of this post, so I won’t go there.

The stuff I highlighted (regarding Maslow’s pyramid) can easily be seen in every meaningful statistic, ranging from birth rates to the average age of the woman giving birth for the first time, to the average age of the first-time home buyer, the average savings and a lot of other statistics. The only issue with them is that you’ve got your favourite media outlet lying about the underlying causes. They’ll tell you that “generation X/Z don’t want the responsibility of raising children”. Or that “they’re doing it because they want to save the planet”. Or some other lie, whatever fits the narrative. In reality, they’re not doing it because they can’t afford it. They can’t afford the home, they can’t afford the childcare costs, they can’t afford a damn thing.

Every significant statistic – ranging from home ownership to homeless people to birth rates, the number of people who need payday loans and all the other stuff I mentioned above – shows the same thing: people can’t afford the BASE of the pyramid, the so-called Physiological Needs.

You said:

The poor is not getting poorer

I say that more people are getting poorer, but the definition of “poor” is being changed to paint a picture of a world that doesn’t exist. It’s enough to take a walk in various European countries/American states to see that the emperor is naked. Yes, more people have smartphones and internet access; they use them to access a bank account with a $17 balance, to check their $50,000-$100,000 debt (student loans and whatever), to access benefits, to ask for food stamps. Oh, there’s also the endless hunt for discounts and freebies, of course.

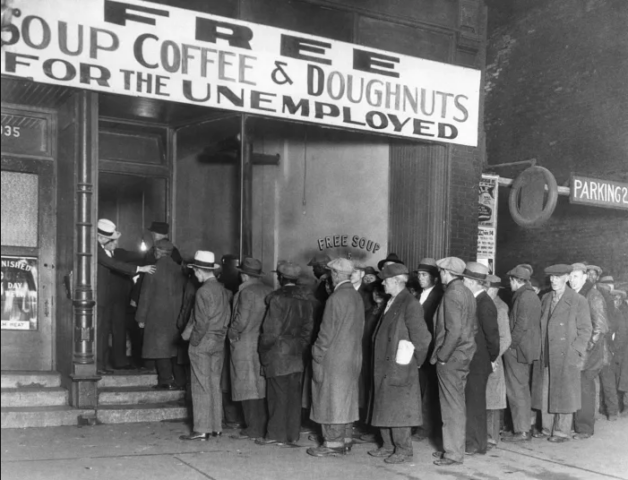

Yes, people have cars. They use them to queue up for free food.

Are we going to pretend that there’s a difference between those guys and these guys?

Why? Just because the other guys weren’t driving? You’re still basically queuing up to get a free meal. It’s just as humiliating now as it was then – and don’t think it’s too different in the UK

What happened here is that the definitions have changed. The old middle-class is now “rich”, whereas the old “poor” are now “middle-class”. You had a guy in the 1960s who, as stated above, owned a house and a car and had a stable blue-collar job. He was married and he had 2-3 children in his 30s. He was middle-class. Well, you now look at a guy who can’t afford to buy a house/flat. He might be a virgin in his 30s. But because he makes something over the “average” wage (and I believe I explained why that’s a lie), he’s now considered middle-class. He can’t afford the base of the pyramid, but he’s “middle-class”. Is he?

There’s one thing that should also be underlined here. You’ll note that I’m referring to home ownership here and one could ask “but what’s wrong with renting?”. The answer to that is..nothing. Nothing’s wrong with renting, as long as it’s safe/stable/affordable. But it isn’t – not anymore. Take the UK – it used to be that you could rent from your local authority (as in, the house was owned by the local authority). For a long time, this was the norm – and renting was cheap. This had an effect on home ownership rates – because nobody actually NEEDED to buy. In order to understand that, we need to once again check the Parliament records:

Based on returns from the Stockton-on-Tees borough council, at April 1984 the average weekly rent per council dwelling was £13.90. The council made a rate fund contribution to its housing revenue account of £1,571 in 1983–84 and has estimated that there will be no rate fund contribution, nor will there be a HRA surplus, in 1984–85. As to main housing subsidy—housing benefit involves no income to the council—the authority had no entitlement in 1983–84 or 1984–85.

(see the average disposable income in 1984 to get an idea of what that meant)

Now let’s take a look at the current situation:

But you need to understand the problem here.

People didn’t need to own a house in the 1960s-1970s here, in the UK. They could rent a council house and, as you can see above, it was CHEAP. As such, there was no reason to buy one – buying it would mean that you’d be the one in charge of repairs, you’d need to pay to get something fixed, as opposed to simply contacting the council and asking them to fix things for you (since they were the “landlord”).

Renting WAS a perfectly valid choice. Cheap, safe, stable. This is why people are able to parrot half-truths, such as “well, home ownership rates in the UK weren’t that much higher in the 60s and 70s” for example. This is true, but the reason for that is that people were CHOOSING to rent. They could’ve bought, but owning a house was seen as a liability instead of an asset – so they chose to rent.

That, however, is no longer the case. Very few people CHOOSE to rent nowadays – usually for mobility reasons. People nowadays rent because they can’t afford to buy; it’s not uncommon for them to spend 50% of their income on rent these days. That’s something you need to keep in mind when looking at home ownership rates, because statistics can be deceiving. We went from “I’ll rent because it’s cheaper that buying and someone else is going to cover repairs etc” to “I’m renting because I can’t afford to buy”.

Leave a Reply